arizona solar tax credit 2019

Before filing ensure you have all documentation as some tax statements are not required to be sent until January 31 such as W-2s 1099s and annual tax summaries. Get the highest efficiency home solar panels available from an industry leader.

Center For Resource Solutions Crs Through Its Green E Certification Programs Certified Nearly 69 Million Megawatt Hours In Retail Transactions In 2019 Representing An Overall Increase Of 11 Compared To 2018 Sales This Is The Highest Number Of

This is how solar panel systems impact your homes value according to Zillow.

. Solar loan Solar lease Solar PPA Buy vs. By clicking GET A FREE QUOTE I authorize ADT Solar to call email andor send me text messages to the phone number provided by me using automated technology about ADT Solar offers and consent is not required to make a. The Size of Your Solar Panel System.

HERO Program Catherine Lane. Credit for Solar Energy Devices Commercial and Industrial Applications. Year E-File and E-Pay Threshold.

TFS was willing to put the. Were here to answer your questions no obligations. 30 of the costs of equipment permits and installation can be claimed back via your Federal tax return.

If your tax bill is 300 but your non-refundable tax credit is 1000 you will only use 300 of your credit and will have 700 unused. Consult your tax advisor regarding the solar tax credit and how it applies to your specific circumstances. 500 annual transaction privilege tax and use tax liability Pursuant to ARS.

If you credit is greater than your tax liability it will not generate a tax refund. It slashes the cost of your installation by nearly a third via a 30 tax credit as long as your system meets the qualification criteria. 1 IN GENERALExcept as otherwise provided by this subsection the amendments made by this section shall apply to property placed in service after December 31 2022 emphasis added.

Every resident in Arizona who installs solar panels gets a state tax credit of 25 of the total system cost up to 1000 to be used toward State income taxes. 2019 Tax Credit. Installed and claimed in 2019 taxes at the.

The average home solar system costs 18300 before tax credits and 12810 after tax credits in 2019. A score we give a solar company out of 100 based on 14 criteria that our SolarReviews industry experts believe are the best criteria to separate good and bad solar companies. Federal tax credit Net metering SRECs Top incentive programs.

Renewable energy equipment in your home can qualify you for a credit of up to 30 of your total cost. Personal income tax. In Arizona purchased household solar systems are eligible for the states 25 solar tax credit.

Local and Utility Incentives. Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer. Section 13102 of the Inflation Reduction Act extends the commercial tax credit for solar panels in Section 48 of the IRC to 2034 with a phase-out beginning in 2032.

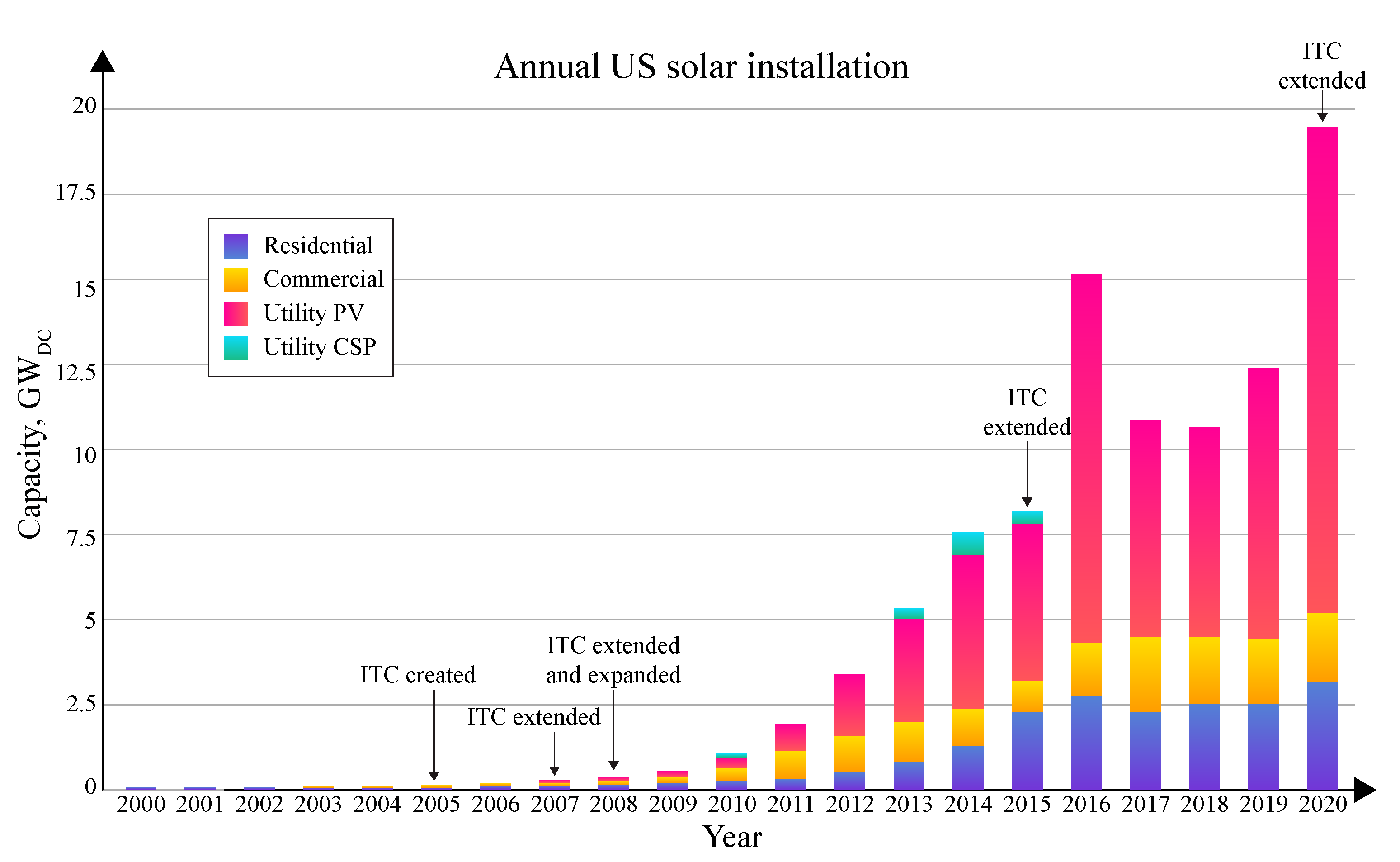

Credit for Qualified Facilities. Concentrated solar power systems use lenses or mirrors and solar tracking systems to focus a large area of sunlight to a. The extension of the 30 percent federal Solar Investment Tax Credit to 2019.

10 Corporate Solar Tax Credit. Electric Vehicles Solar and Energy Storage. At the time of writing December 2019 no other consumer website can do this.

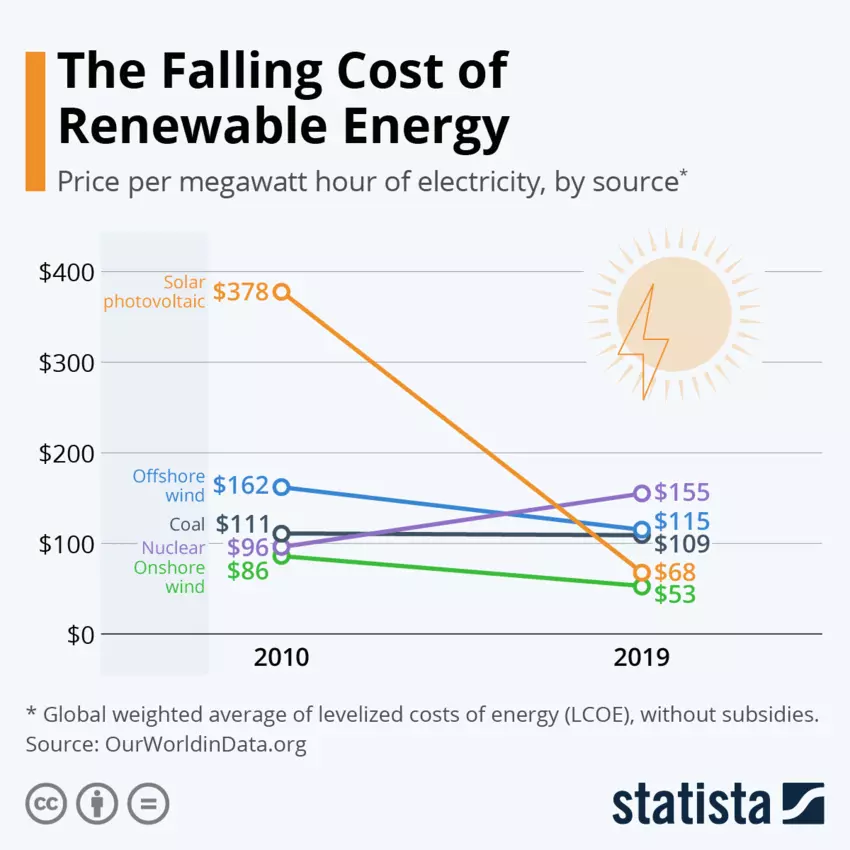

The federal Investment Tax Credit ITC is one of the major reasons many people choose to go solar. Solar power is the conversion of energy from sunlight into electricity either directly using photovoltaics PV indirectly using concentrated solar power or a combination. The Federal solar energy tax credit is a tax credit thats available if you decide to install a solar system.

42-5014 and 42-1129. The size of your solar panel system has a direct impact on your monthly electric bill. Arizona solar tax credit.

The State of Arizonas individual income tax filing season has launched and is now accepting electronically filed 2021 income tax returns. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit. Lease solar Solar financing companies.

Heres a quick example of the difference in credits in 2019 and 2021 for a 27000 9 kW solar array. Most residential solar panel systems are anywhere from 5 to 10 kilowatts kW. Get more Solar Ready Vets information here.

The SEIA initiative to bring 50000 veterans into the solar industry. 2019 Tax Credit. The size of your solar panel system among other factors influences the number of kilowatt-hours kWh that are produced.

Then the pandemic hit and we werent sure what was going to happen to our business. This extends the tax credit to the end of 2032 because subsection a of Section 13301 of the Inflation Reduction Act is what extended the credit. Arizona offers state solar tax credits-- 25 of the total system.

Installation of the PV system must have been between January 1 2006 and December 31 2019. New Mexicos solar tax credit is back with big savings Catherine Lane. Based on search of datasheet values from websites of top 10 manufacturers per IHS as of January 2017.

Photovoltaic cells convert light into an electric current using the photovoltaic effect. Credit for Solar Hot Water Heating Plumbing Stub Outs and Electric Vehicle Recharge Outlets. Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger.

Starting January 1 2022 your maximum tax savings will be 30 of whatever the panels cost your business or real estate activity. The only other place such accurate functionality is available is in professional. We contracted w TFS at the end of 2019.

2019 Tax Credit. According to the Solar Energy Industries Association the credits extension is expected to create 220000 jobs within the next five years. Fortunately the Geothermal Tax Credit allows homeowners to apply their tax credit over multiple years.

Learn about 0 down financing. That projected cost is likely to change in the future as material costs vary and the federal tax credit winds down.

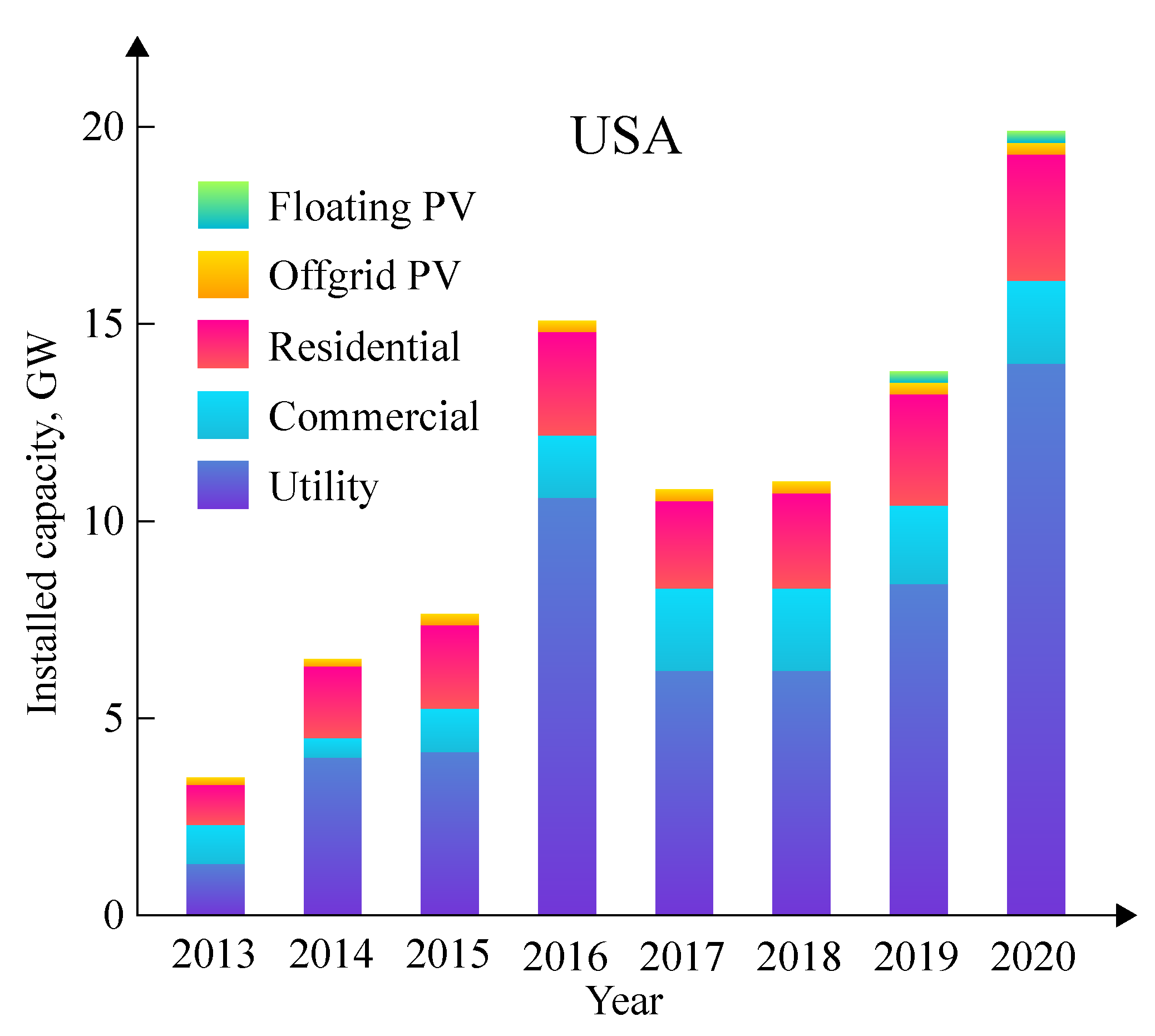

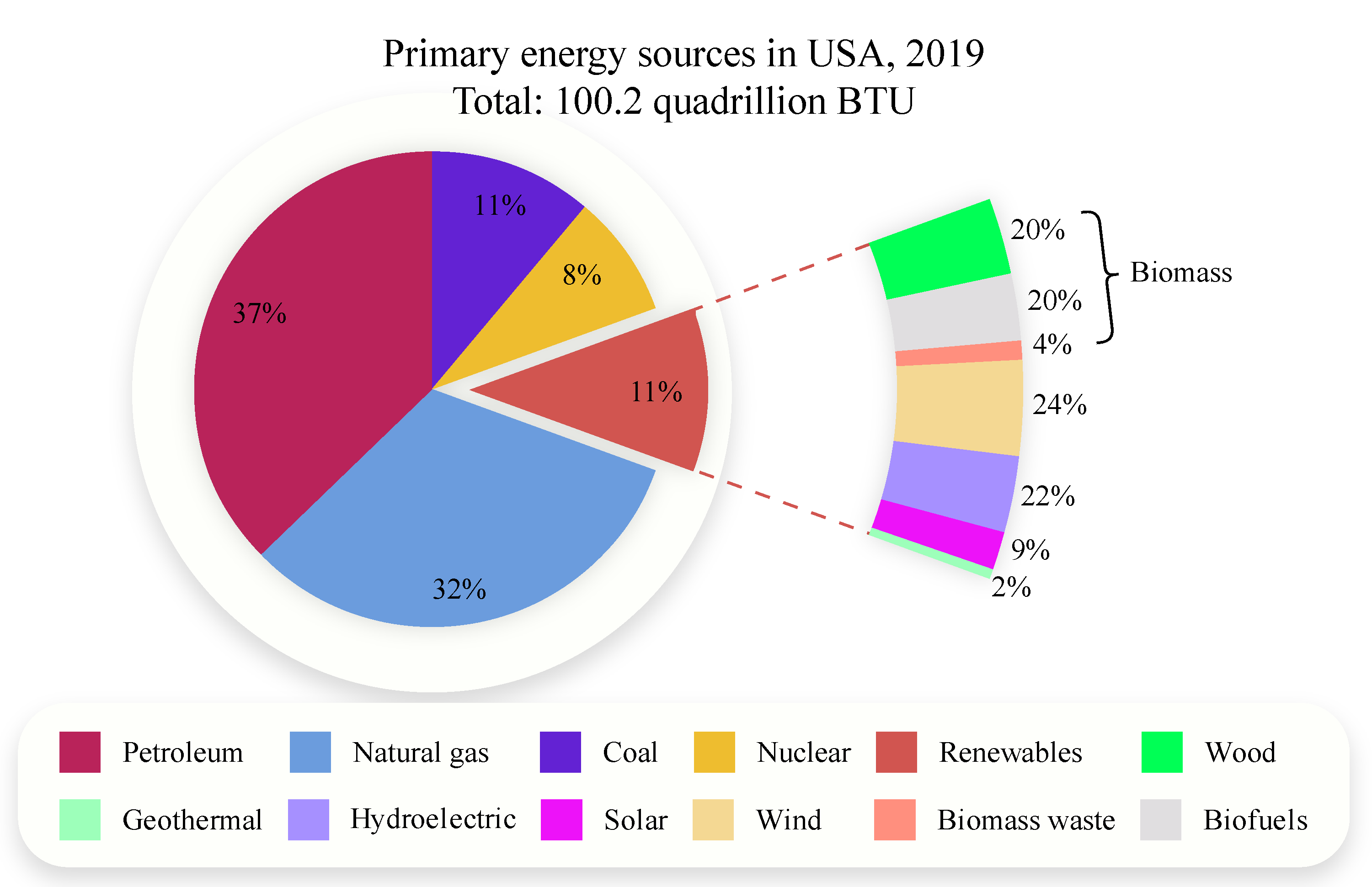

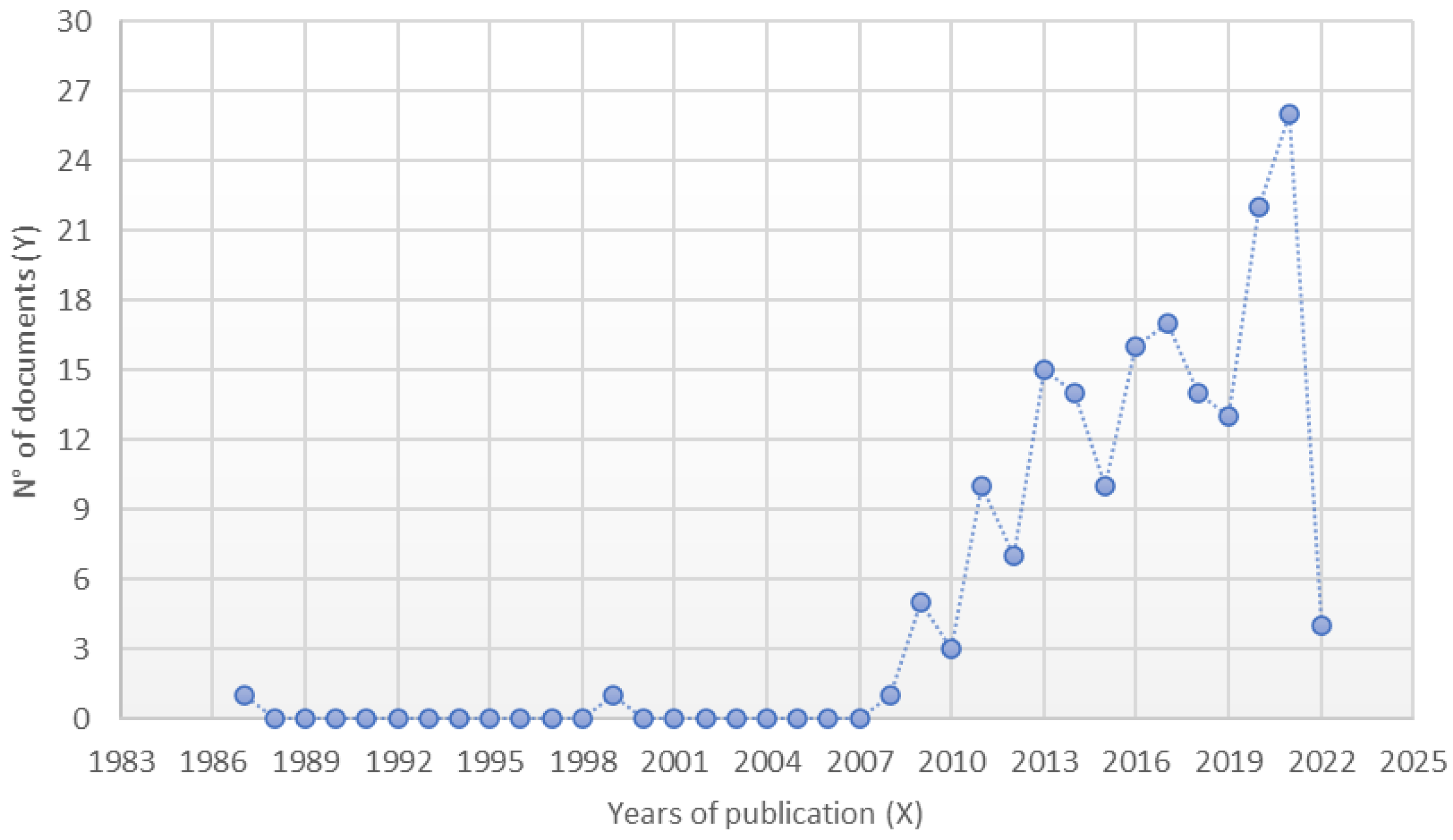

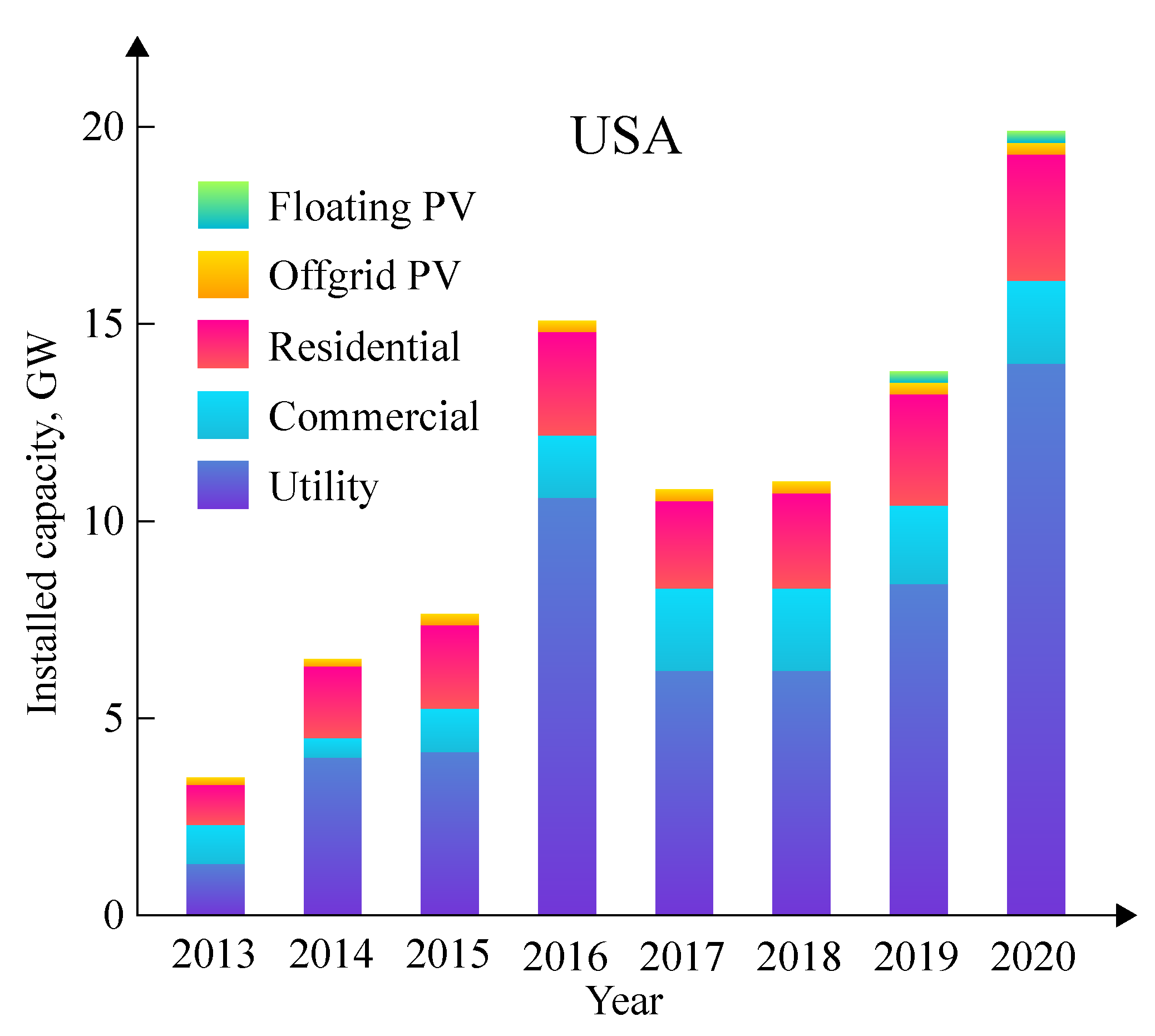

Energies Free Full Text Solar Energy In The United States Development Challenges And Future Prospects Html

The Future Of Solar Energy Hoymiles

Download The Power And Electricity World App Green Building Africa

First Solar Powered Electric Vehicle Charging Station In Croatia Opens Electric Vehicle Charging Station Electric Charging Stations Car Charging Stations

Sustainability Free Full Text The Cost Benefit Analysis Of Commercial 100 Mw Solar Pv The Plant Quaid E Azam Solar Power Pvt Ltd Html

Federal Solar Tax Credit For Homeowners Complete Guide Energysage

The Federal Solar Tax Credit Has Been Extended Through 2023 Ecohouse Solar Llc

Energies Free Full Text Solar Energy In The United States Development Challenges And Future Prospects Html

Planning For Utility Scale Solar Energy Facilities

Federal Solar Tax Credit How It Works Explained In Plain English Sun Source Homes

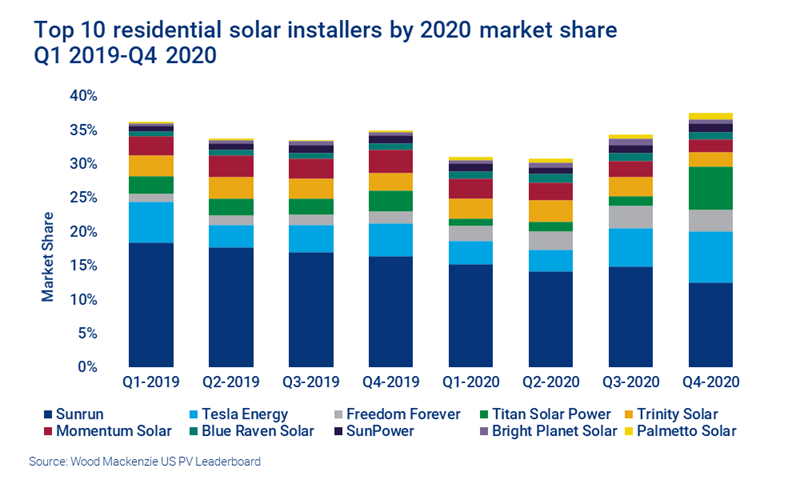

Sunrun Retains Its Title As Largest Residential Solar Installer In The Us Wood Mackenzie

Energy Design Rating Energy Consulting Energy Energy Efficient Buildings

Nasa Wants To Send Humans To Mars In The 2030s Here S The Step By Step Timeline Space Hotel Bigelow Solar Panel Cost

March 16 2017 Mimas In Saturnlight Image Credit Cassini Imaging Team Ssi Jpl Esa Nasa Exp Cassini Spacecraft Astronomy Pictures Cassini Saturn

Solar Tax Credit In 2021 Southface Solar Electric Az

Pricing Incentives Guide To Solar Panels In Hawaii 2022 Forbes Home

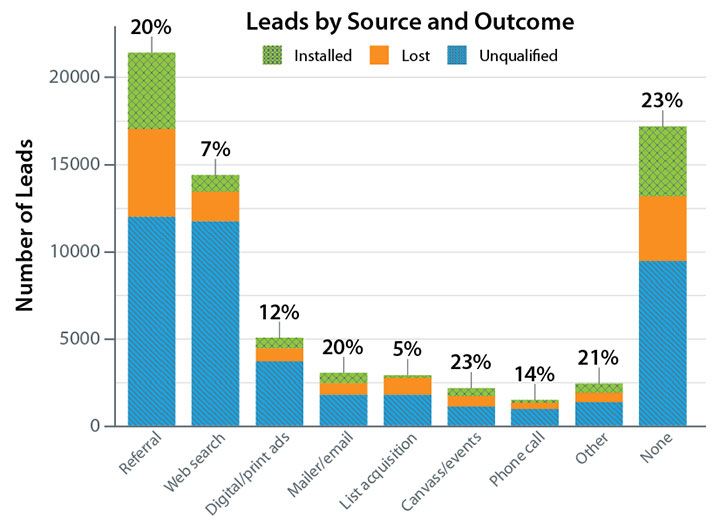

Solar Energy Evolution And Diffusion Studies Webinars Solar Market Research And Analysis Nrel

Energies Free Full Text Solar Energy In The United States Development Challenges And Future Prospects Html